Tam Macro is an investment newsletter that provides recommendations on a concentrated portfolio typically consisting of 6 – 12 Exchange Traded Funds (ETFs) and individual stocks. The portfolio is focused on macroeconomic themes and valuation, drawing from the founder’s decades of experience studying the markets.

The investments are typically held for a minimum of 1 – 3 months and a maximum of several years. The portfolio is contrarian in nature.

A major portion of the portfolio (at least 20%) is always allocated to the S&P500 index, either long or short. The remainder of the investments may be domestic or international, though they are always available on major US exchanges.

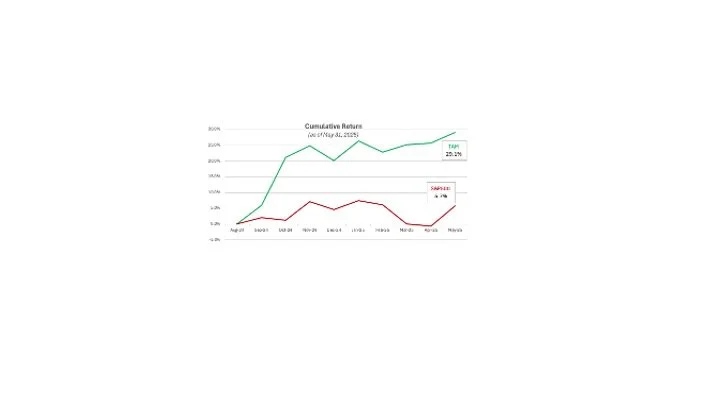

The founder’s belief in the superior potential of a concentrated, contrarian strategy based on macroeconomic and valuation analysis is supported by the consistent outperformance of the Tam Macro portfolio in comparison to the S&P500 index.

The founder’s credentials include degrees from Stanford University and the University of California at Berkeley, as well as experience at one of the largest US stock brokerages, based in San Francisco. The newsletter’s name has its origins in the company’s location at the base of Mt. Tamalpais in Marin County, California.