Tam Macro

Strategic Investing in Macro Trends

Tam Macro is an investment newsletter that provides recommendations on a

concentrated portfolio typically consisting of 4 – 10 Exchange Traded Funds (ETFs) and individual stocks. The portfolio is focused on macroeconomic themes and valuation, drawing from the founder’s decades of experience studying the markets.

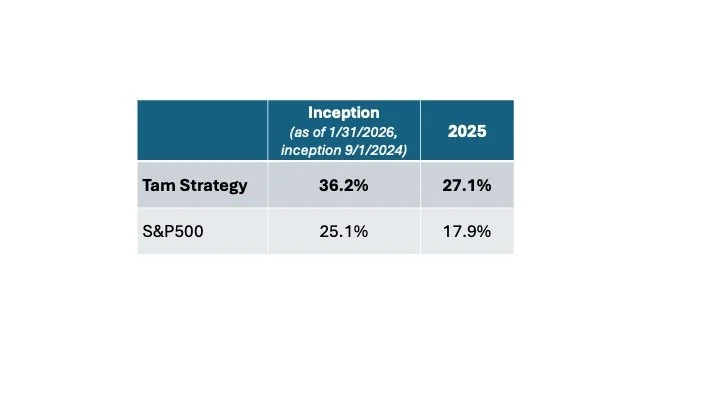

For those investors who wish to have broad exposure to the US stock market, Tam Macro also offers Tam Strategy, which enters and exits the US S&P 500 at opportune times, maintaining a small short position during anticipated market weakness.

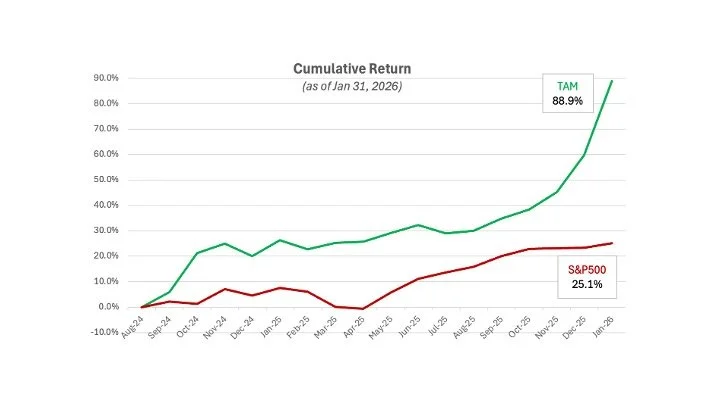

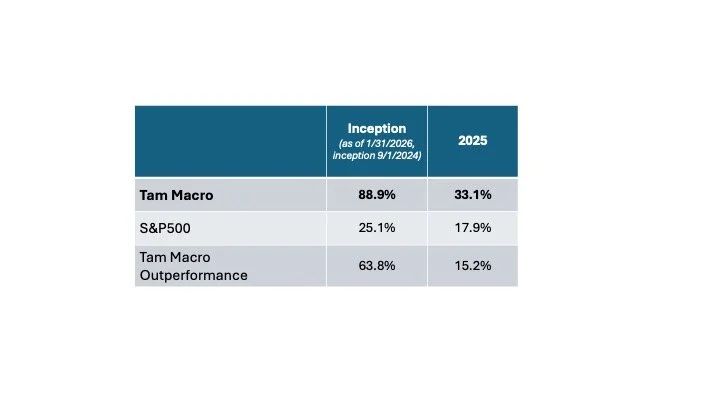

Both portfolios have consistently outperformed the US market.

Tam Macro Portfolio

Focused. Contrarian. Proven.

The investments are typically held for a minimum of 1 – 3 months and a maximum of several years. The portfolio is contrarian in nature.

A major portion of the portfolio (at least 20%) is always allocated to the S&P500 index, either long or short. The remainder of the

investments may be domestic or international, though they are always available on major US exchanges.

The founder’s belief in the superior potential of a concentrated, contrarian strategy based on macroeconomic and valuation analysis is

supported by the consistent outperformance of the Tam Macro portfolio in comparison to the S&P500 index.

Tam Strategy Portfolio

A second portfolio, Tam Strategy, is suitable for investors who prefer broad exposure to the US stock market, as well as capital preservation during periods viewed as excessively risky. The Tam Strategy portfolio is either allocated 100% long to an S&P 500 ETF or 30% short/70% US treasury bonds during periods of anticipated market declines.

Built on Investment Experience and Rigorous Learning

The founder’s credentials include degrees from Stanford University and the University of California at Berkeley, as well as experience at one of the largest US stock brokerages, based in San Francisco.

The newsletter’s name has its origins in the company’s location at the base of Mt. Tamalpais in Marin County, California.

Join an Investment Newsletter

Rooted in a Unique Vision and

Consistent Outperformance

Get expert-driven investment insights through a concentrated, macro-focused portfolio that consistently outperforms the S&P 500. Backed by decades of experience and top academic credentials.